Tesla, Inc. (TSLA) continues to redefine expectations in the electric vehicle (EV) and renewable energy sectors. Known for its cutting-edge technology and commitment to sustainability, Tesla is not only a leader in the automotive industry but also a vanguard for environmental innovation. With a market capitalization of approximately $993 billion and substantial revenue streams driven by global demand for eco-friendly vehicles, Tesla has captured the attention of investors worldwide. This comprehensive analysis provides an in-depth look at Tesla’s financial performance, market positioning, and future opportunities. By exploring these elements, potential investors can make informed decisions about engaging with Tesla’s stock. Join us as we delve into the dynamics of TSLA, a pivotal player in the race towards a sustainable future.

Business Overview of Tesla, Inc.

Company Profile & Vision

Tesla, Inc. (TSLA) stands as a vanguard in the electric vehicle revolution, consistently pushing the boundaries of automotive and energy innovation. Based in Austin, Texas, Tesla’s primary mission is to accelerate the world’s transition to sustainable energy. The company operates through two main segments: Automotive and Energy Generation and Storage. These sectors not only reflect Tesla’s commitment to renewable energy but also represent a significant shift in consumer preference towards eco-friendly solutions.

- Automotive Segment: Tesla is renowned for its portfolio of high-performance electric vehicles, which includes diverse offerings such as the Model S sedan, Model 3 sedan, Model X SUV, and Model Y crossover. Additionally, Tesla capitalizes on regulatory credits, delivering after-sales services, and offering vehicle insurance, expanding its revenue streams within the automotive sector. The Tesla Supercharger network enhances customer satisfaction by providing convenient, rapid charging solutions globally.

- Energy Generation and Storage: Complementing its automotive division, Tesla offers solar products and energy storage systems like Powerwall, Powerpack, and Megapack. These products cater to residential, commercial, and industrial customers, emphasizing Tesla’s commitment to a sustainable lifestyle that extends beyond transportation.

Industry Position and Competitive Advantage

Tesla’s prominence in the Consumer Discretionary sector, specifically among Automobile Manufacturers, is evidenced by its substantial market capitalization. Its pioneering technologies have carved a competitive edge that keeps it ahead of traditional automakers.

- Market Share & Competitors: Tesla commands a significant share of the global EV market, competing with major players like General Motors, Ford, and newcomers such as Rivian and Lucid Motors. Tesla’s first-mover advantage in many markets allows for a robust brand presence and an expansive customer base.

- Innovations: Tesla’s continuous investment in research and development has led to the creation of high-efficiency battery technologies and advanced autonomous driving features. These technological advancements are not just products; they are integral to Tesla’s strategy of vertically integrating its supply chain—from Gigafactories producing batteries to its direct-to-consumer sales model. This integration aids in cost control and enhances customer experiences, thereby building loyalty and fostering Tesla’s reputation as an innovation leader.

Sustainability and Environmental Impact

Tesla’s core philosophy revolves around sustainability—both in product offering and corporate responsibility. The company is not just an automaker; it’s a catalyst for a broader shift towards renewable energy solutions.

- Commitment to Green Energy: Tesla’s commitment to green energy is reflected in its extensive line of solar energy solutions and cutting-edge battery storage systems. By integrating renewables with traditional grid solutions, Tesla is paving the way toward a sustainable energy future.

- Innovations in Renewable Energy Solutions: With products like the Tesla Solar Roof and the aforementioned energy storage solutions, Tesla is reducing the dependability on fossil fuels by providing organizations and households with viable green alternatives. The Gigafactories are also strategically located to minimize carbon footprints and enhance production efficiency.

Actionable Insights for Investors

- Growth Potential: Tesla’s aggressive global expansion, coupled with robust growth in the EV sector, suggests significant potential for future earnings growth.

- Profitability: Tesla’s ability to generate consistent profits from regulatory credits alongside its innovative product lines provides a buffer against market volatility.

- Risk Considerations: Investors should consider Tesla’s exposure to supply chain disruptions, competitive pressures, and regulatory changes as potential risks impacting long-term growth.

Financial Performance and Metrics

Analysis of Revenue and Profit Margins

Tesla, Inc. (TSLA) has maintained a consistent trajectory of remarkable growth in its financials, positioning itself as a dominant force within the electric vehicle (EV) sector. The company’s recent revenue figures provide a clear testament to its market leadership, with total revenue nearing an impressive $93 billion. This substantial revenue stream, achieved through robust sales across its expanding vehicle lineup, underscores Tesla’s ability to capitalize on increasing consumer demand for sustainable energy solutions.

- Recent financial results highlight a continued upward trend in revenue, driven by strong vehicle deliveries and strategic international market penetration, particularly in China and Europe.

- Despite volatile automotive market conditions, Tesla has managed to sustain healthy profit margins. The company’s focus on operational efficiency and cost management has not only bolstered its bottom line but also enhanced gross profit margins, illustrating adept financial stewardship.

For investors, the trends suggest that while market fluctuations may pose challenges, Tesla’s ability to innovate and scale its operations effectively could lead to sustained profitability and value creation over the long term.

Market Capitalization and Stock Valuation

With a staggering market capitalization of approximately $993 billion, Tesla asserts itself as one of the most substantial entities in the global equity market. This valuation highlights compelling investor confidence in Tesla’s long-term growth prospects and technological edge.

- Tesla’s current stock price of $307.83 has witnessed a market correction from its 52-week high of $488.54. This adjustment reflects recalibrated market expectations, yet the stock’s rebound above its 52-week low indicates renewed investor sentiment.

- Comparatively, Tesla’s valuation metrics can be juxtaposed with industry peers like Rivian and Lucid Motors. Tesla’s P/E ratio, a critical indicator of investor expectations relative to earnings, suggests market anticipation of future growth that is robust but contrasts with the more nascent valuation ecosystems of emerging EV players.

For investors evaluating Tesla’s stock, the differentiation in valuation between Tesla and its peers could present opportunities to assess intrinsic value versus market-anticipated growth. It emphasizes the importance of aligning stock purchases with individual investment timelines and risk tolerance.

Cash Flow and Debt Management

Tesla’s liquidity profile is a cornerstone of its financial strategy, with total cash reserves approximating $36.78 billion. This robust cash position not only strengthens Tesla’s balance sheet but also provides strategic flexibility to navigate market dynamics and capitalize on potential investment opportunities.

- The company’s strong operational cash flow generation highlights its capability to self-fund growth initiatives, pivotal for reinvestment in technology and infrastructure.

- With total debt standing at $13.13 billion and an impressively low debt-to-equity ratio of 16.823, Tesla showcases disciplined debt management. This low leverage indicates a conservative approach to financing, reducing financial risk and enhancing shareholder value.

Tesla’s strategic avoidance of dividend payouts reflects a focus on reinvestment for future innovation and expansion. This approach aligns with the broader vision of expansion and maintaining Tesla’s forefront position in technology and market presence in the EV sector.

Actionable Insights for Investors:

- Consider Long-term Growth Potential: Investors should weigh Tesla’s innovative capacity and expansion strategies against current market valuations and potential short-term volatility.

- Evaluate Financial Ratios: Understanding Tesla’s profit margins, P/E ratio, and debt profile can provide insights into the sustainability of its financial health and competitive advantage.

- Monitor Strategic Investments: Continuous monitoring of Tesla’s reinvestment initiatives and market positioning could offer indicators for future growth trajectories and operational health.

Analyst Sentiment and Market Projections

Current Analyst Ratings

Tesla, Inc. (TSLA) continues to captivate the attention of market analysts with its dynamic growth trajectory and innovative propositions in the electric vehicle and energy sectors. As it stands, a substantial number of analysts have issued a “hold” recommendation on the stock. This suggests that while Tesla maintains a solid foundation, a lack of significant catalysts currently tempers the enthusiasm for aggressive buying or urgent selling.

- Hold Recommendations: These reflect a consensus that Tesla’s present market valuation adequately incorporates the company’s strengths and potential headwinds. A “hold” consensus advises investors to maintain their positions and carefully monitor emerging market trends.

- Implications of Analyst Ratings: An overarching sentiment of “hold” implies stability, hinting at expected sector developments or internal milestones before a shift in buying sentiment emerges.

Target Price Forecasts

The mean target price currently sits at $305.12, which informs that the stock is trading marginally above this consensus, with its current price at $307.83. This proximity suggests a limited upside potential in the immediate future as perceived by analysts.

- Mean Target Price vs. Current Price: The somewhat negligible gap between the mean target and current trading price signals a balanced outlook. It invites measured patience from investors, encouraging a focus on Tesla’s medium to long-term narrative.

- Long-term Projections: The wide range between the high target price of $500 and the low of $115 underscores the diverse perspectives on Tesla’s trajectory. Enthusiasts see Tesla capitalizing on growth in EVs and energy storage, while skeptics remain wary of potential obstacles such as supply chain disruptions or competitive pressures capturing market share. With a median target price of $320, investors are counseled to consider Tesla’s strategic decisions and market trends before committing additional resources.

Market Speculations and Expectations

Several factors are positioned to influence Tesla’s stock prices significantly. Keeping abreast of these variables offers actionable insights for investors aiming to make informed decisions.

- Influential Factors Affecting Stock Price:

– Technological Advancements: Ongoing innovations, particularly in battery technology and autonomous driving capabilities, could propel Tesla to new heights, potentially exceeding current analyst predictions.

– Regulatory Changes: Local and global policy shifts towards sustainable energy could complement Tesla’s objectives, driving potential upside.

– Competitive Landscape: Emerging competitors and traditional automotive giants venturing into the EV space might exert pressure, challenging Tesla’s market dominance.

- Expected Market Responses:

– Investor Watchfulness: Given the volatility in the current predictions, a keen eye on quarterly earnings reports, regulatory news, and competitive announcements will be pivotal.

– Prospective Opportunities: Strategic partnerships or expansions into new markets can bolster investor confidence and stimulate bullish market responses.

– Risk Assessment: Vigilance towards macroeconomic conditions and supply chain stability will remain critical, as they possess profound ramifications for Tesla’s operational success and stock performance.

By astutely navigating these complex dimensions, investors can align their strategies with Tesla’s unfolding narrative, poised for a future characterized by innovation and ingenuity.

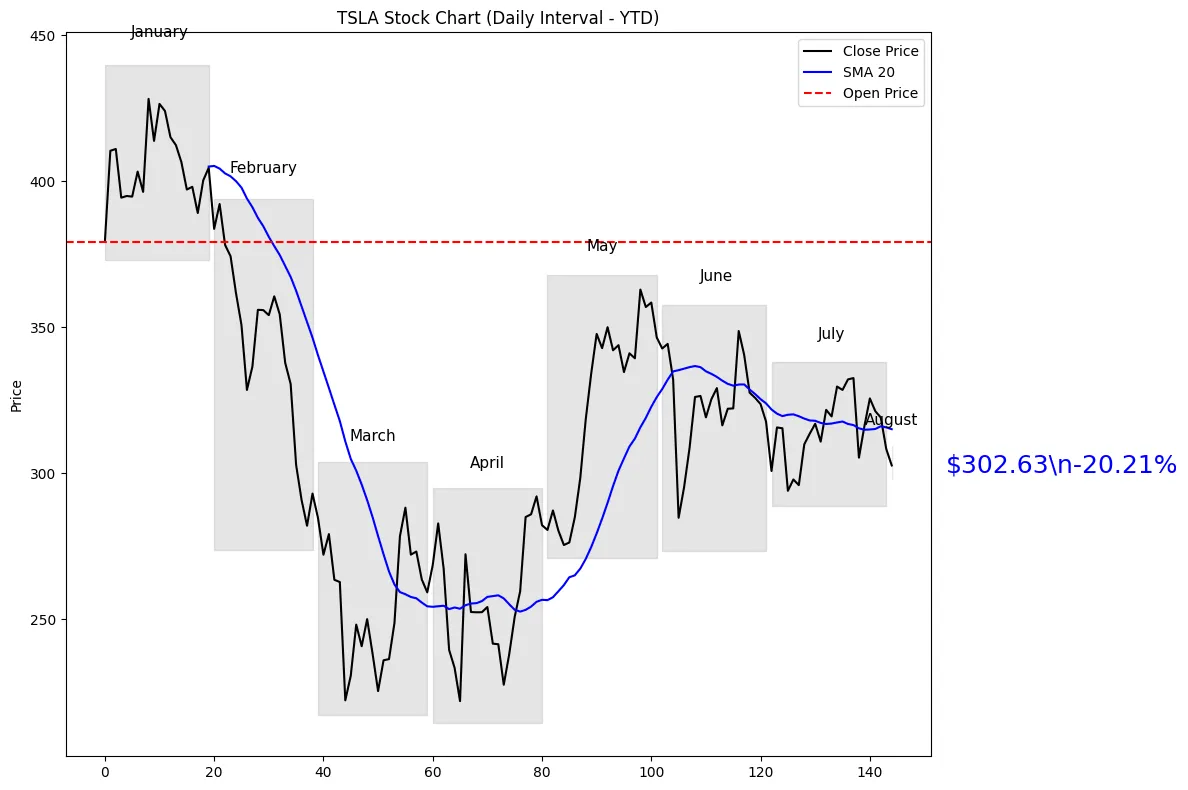

Technical Analysis of TSLA Stock

Moving Averages and Indicators

Analyzing Tesla, Inc. (TSLA) with regards to its moving averages provides valuable insights into its current market sentiment. As of the latest data, TSLA is trading at $307.83, which sits below both its 50-day moving average of $322.99 and the 200-day moving average of $321.59. Generally, when a stock trades below these pivotal moving averages, it signifies bearish sentiment, suggesting that sellers might have the upper hand unless a bullish reversal occurs.

Diving into indicators, the Relative Strength Index (RSI), a momentum oscillator that measures the speed and change of price movements, indicates moderate bearish pressure but not yet oversold at this juncture. The Moving Average Convergence Divergence (MACD), another essential technical indicator, tracks the relationship between two moving averages of a stock’s price, reinforcing a bearish indicator.

Volume and Volatility Considerations

Understanding the volume is crucial in confirming price movements and overall market interest. TSLA’s current trading volume is significantly below its average, suggesting a consolidation phase or investor hesitation. Additionally, TSLA holds a high beta value, indicating that it is considerably more volatile than the general market.

Support and Resistance Levels

Identifying support and resistance levels is crucial for formulating successful trading strategies. Key support at $290 offers stability, whereas $350 serves as a significant resistance point, offering cues for strategic placements.

Historical Patterns and Predictions

Examining TSLA’s historical price patterns provides further clarity on its probable future trajectory. Historical trends, like the double bottom formation earlier in the year, offer prospective insights into potential market movements.

Actionable Insights for Investors

- Monitor Moving Averages: Keep an eye on TSLA’s price in relation to its 50-day and 200-day moving averages to gauge potential shifts in market sentiment.

- Evaluate Volume Trends: Watch changes in trading volume, as significant deviations could foreshadow forthcoming price movements.

- High Beta Awareness: TSLA’s high beta demands careful risk management; it’s essential to remain responsive to both market trends and individual stock news.

- Support and Resistance Cues: Use the identified support and resistance levels as critical triggers for making informed entry and exit strategies.

Risk Assessment of Investing in TSLA

Volatility and Beta Analysis

Tesla’s stock volatility, marked by a high beta, is a critical consideration. High volatility can lead to substantial price fluctuations, appealing during bullish markets but posing risks during downturns.

External Market Risks

Tesla’s performance is intricately linked to various economic and regulatory factors, including fluctuating consumer sentiment and spending, stringent regulations, and market competition.

Long-term vs. Short-term Investment Risks

Understanding the risk horizon is crucial for TSLA investors. Short-term risks often entail significant price volatility, while long-term risks might focus on issues like debt management and macroeconomic influences.

Prudent Investment Strategies

- Portfolio Diversification: Incorporate TSLA into a diversified portfolio to balance volatility.

- Assessing Risk Tolerance: Determine personal risk tolerance. High beta stocks like TSLA may not align with conservative strategies.

- Continuous Monitoring: Stay informed on Tesla’s financial health and market position for timely adjustments.

Chart Analysis and Historical Trends

Year-to-Date Stock Trends

TSLA’s year-to-date performance has been dynamic, reflecting periods of both bearish and bullish momentum, with recent months showcasing consolidated trends indicative of market indecision.

Key Support and Resistance Discovery

Support at $250 and resistance at $400 are critical markers for tracking potential market movements and setting strategic trade parameters.

Trend Strength and Reversal Indicators

Double Bottom formations and deviations from moving averages offer insights into potential reversals or continued trends, particularly under scrutiny of Tesla’s historical performance and technical analysis.

Actionable Insights for Investors

- Monitor the relationship with moving averages to better predict market sentiment shifts.

- Pay attention to trading volume fluctuations for signals of potential trend reversals.

- Watch for price confirmations near key resistance or support for timely trade execution.

Strategic Investment Opportunities with TSLA

Growth Potential in Emerging Markets

Tesla is strategically positioned to capitalize on the rising demand in emerging markets, strengthened through local partnerships and adherence to environmental policies.

Investment Diversification Strategies

Pairing TSLA with complementary tech stocks and diverse asset classes can enhance stability and reduce exposure to sector-specific risks.

Leveraging Tesla’s Technological Innovations

Tesla’s advancements in technologies such as battery efficiency and autonomous driving present enormous potential for future growth.

—

Conclusion and Investment Outlook

Tesla, Inc. (TSLA) remains at the forefront of innovation and sustainability, creating substantial opportunities for investors. Its strong financial performance and strategic vision offer a compelling narrative for long-term growth. The stock, although marked by volatility, presents a unique opportunity for both growth and diversification. Potential investors should weigh short-term fluctuations against Tesla’s broader market potential to make informed investment decisions.

Disclaimer

The information provided in this article is for educational purposes only and should not be considered as financial advice. Please consult with a financial advisor before making any investment decisions. Investing involves risk, and it is important to conduct personal research before committing to investment positions.