Tesla, Inc. (TSLA) remains a trailblazer in the electric vehicle (EV) and renewable energy sectors, demonstrating continued growth and innovation in its offerings. As of October 2023, the company stands at the forefront of the market, passionately committed to promoting sustainability through groundbreaking technology. This article provides an in-depth look at Tesla’s current stock performance, financial health, business segments, and strategic outlook.

Overview of Tesla, Inc.

Founded in 2003 and headquartered in Austin, Texas, Tesla, Inc. has established itself as a key player in the consumer cyclical sector. The company operates in two major segments: Automotive and Energy Generation and Storage. Tesla is primarily engaged in the design, development, manufacturing, leasing, and sale of electric vehicles, as well as energy generation and storage systems.

Electric Vehicles

The Automotive segment is a significant component of Tesla’s business model. It includes the design and manufacturing of a diverse lineup of electric vehicles, which encompasses sedans and sport utility vehicles (SUVs). Tesla customers benefit from an extensive range of services, which go beyond mere vehicle purchases. This includes automotive regulatory credits, non-warranty after-sales service, used vehicle sales, body shop and parts sales, supercharging stations, and vehicle insurance.

One of Tesla’s defining features is its direct sales model, where customers can purchase vehicles directly from the company through its website and mission-driven stores. This approach enables the company to maintain control over the customer experience, provide personalized interactions, and enhance brand loyalty.

Energy Generation and Storage

In addition to its automotive operations, Tesla’s Energy Generation and Storage segment plays a crucial role in the company’s commitment to sustainability. Tesla designs, manufactures, and sells solar energy solutions and energy storage products. The company’s solar energy offerings include solar panels, solar roofs, and energy storage systems designed for residential, commercial, and industrial customers.

Tesla’s energy division functions through a robust network of installation and financing solutions, which allow customers to harness the power of the sun and store it effectively for future use. This sector not only diversifies Tesla’s revenue streams but also aligns with global efforts toward renewable energy and reducing carbon footprints.

Current Market Performance

As of October 2023, Tesla is positioned favorably in the stock market with a market capitalization of approximately $761.12 billion. This substantial valuation reflects its prominence in the industry and ongoing investor confidence in the company’s potential for growth and profit.

Stock Pricing Insights

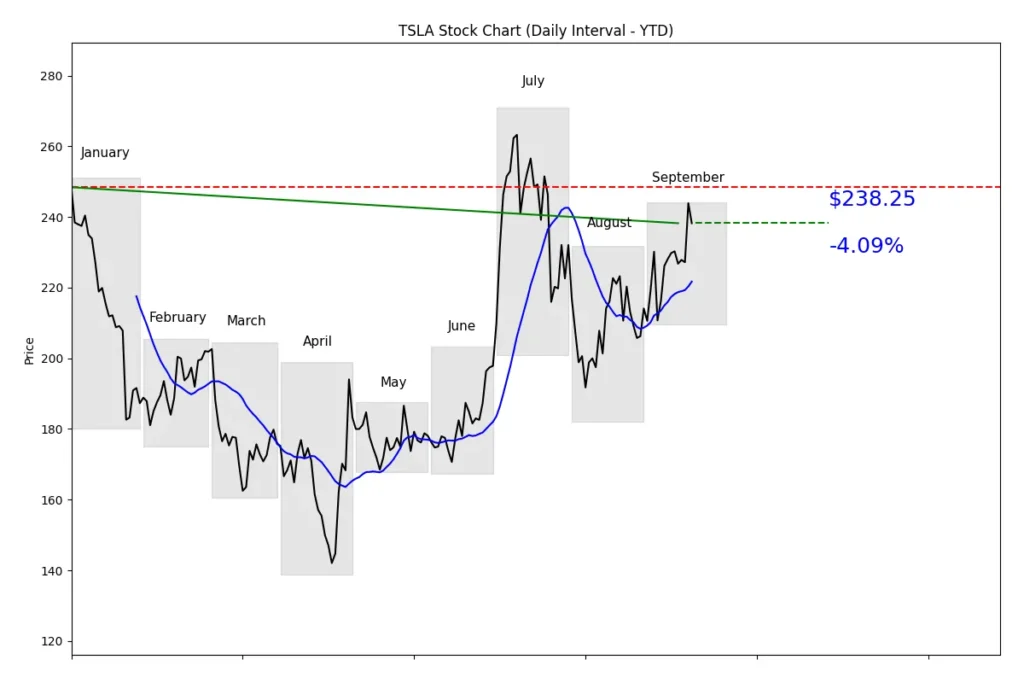

Tesla’s current stock price stands at $238.25. This is a significant increase from its 200-day average of $202.27, indicating strong upward momentum. Additionally, the stock has seen a 52-week high of $271, showcasing Tesla’s ability to capture investor interest during periods of market fluctuation. Despite its robust performance in recent months, Tesla has also faced challenges, with the stock experiencing a 52-week low of $138.80.

This stock performance has contributed to a 52-week change of -3.54%, reflecting some volatility within the shares. Nevertheless, the projected target median price for Tesla stands at $222.50, with an optimistic target high price reaching $310. Such projections indicate that market analysts remain bullish on Tesla’s long-term value despite facing short-term fluctuations.

Trading Volume Dynamics

The trading volume for Tesla shares has been notably active. With a current trading volume of 98,965,572 shares and an average volume of 76,296,800 over the past ten days, it is clear that investor interest remains high. This level of activity suggests strong liquidity in the market and allows for timely entry and exit strategies for buyers and sellers alike.

Financial Health and Key Metrics

Tesla’s financial metrics paint a broad picture of the company’s health, with a total revenue of approximately $95.32 billion. This impressive revenue generation reinforces Tesla’s capability as a market leader, primarily within the EV sphere. However, it’s important to note the earnings quarterly growth, which shows a significant decline of -45.3%. Investors may be wary of this figure, signaling the need for a conducive environment for Tesla to return to previous growth rates.

Cash Reserves and Debt Management

Tesla operates with total cash reserves of $30.72 billion, which provides the company with a flexible financial position to sustain its operations and continue investing in innovative projects. The company also has total debt amounting to $12.52 billion, leading to a debt-to-equity ratio of 18.606. This level of leverage should remain manageable given the impressive cash position, though it will require monitoring as market conditions evolve.

Moreover, Tesla’s average volume of 96,919,769 further signifies strong trading activity, which is crucial for maintaining a balanced and flexible market presence.

Investor Sentiment: Short Interest Analysis

Understanding investor sentiment is essential for evaluating Tesla’s stock outlook. Currently, the short percent of float is at 2.83%, indicating that a moderate portion of Tesla’s shares are being shorted. This level of short interest, with approximately 78,698,016 shares short, indicates a relatively cautious sentiment among some investors.

The short ratio stands at 1.06—a figure that reflects a general lack of extreme bearish sentiment. While some traders may be betting against the stock, the majority appear to retain confidence in Tesla’s long-term potential. The short interest can serve as a useful barometer for gauging potential price movements, especially if bullish market dynamics emerge.

Business Segmentation and Market Strategy

Tesla’s operations are compelling due to its dual focus on both the automotive and energy sectors. This strategic diversification helps hedge against fluctuations in any single market.

Automotive Segment

The Automotive segment not only provides Tesla’s flagship products but also encompasses a substantial ecosystem of services that heighten customer engagement. Apart from electric vehicles, Tesla offers automotive regulatory credits, which have emerged as a unique revenue stream in the EV space. This system incentivizes manufacturers to produce zero-emission vehicles and contributes positively to Tesla’s financial bottom line.

Tesla also operates a robust infrastructure of Tesla Superchargers, allowing customers convenient access to fast-charging stations necessary for long-distance travel, enhancing the practicality of owning an electric vehicle. In-app upgrades and various financing options further increase accessibility for consumers.

Energy Generation and Storage Segment

In the Energy Generation and Storage segment, Tesla engages in a variety of initiatives designed to empower utility customers. This includes a portfolio of solar energy solutions and energy storage products, vital for promoting renewable energy use.

Tesla’s adaptable approach allows it to cater to different energy needs—from individual residential installations to utility-scale projects. The focus on service provision has been central to Tesla’s philosophy of ensuring that customers derive optimal value from their solar and energy storage investments.

Future Outlook

The future appears promising for Tesla, considering the ongoing global shift toward sustainability and electric mobility. The company’s strategic positioning across both automotive and energy sectors provides a strong foundation to capture growth as the demand for clean energy and electric vehicles rises.

Anticipating Market Trends

As governments worldwide enact policies promoting electric vehicles and renewable energy, companies like Tesla that are already established in these markets stand to benefit considerably. The company’s dedicated focus on research and development will likely yield new product innovations tailored to evolving customer preferences and regulatory landscapes.

Additionally, Tesla’s global expansion strategies aim to tap into emerging markets that demonstrate high growth potential in the automotive and energy sectors. With operations in the United States, China, and international markets, Tesla is well-placed to leverage these opportunities, especially in regions with growing consumer interest in electric vehicles.

Conclusion

In closing, Tesla, Inc. (TSLA) embodies the ethos of innovation and sustainability within the electric vehicle and energy markets. The company continues to maintain a strong stock performance, backed by impressive revenue figures. While short-term earnings challenges have arisen, Tesla’s commitment to technology and sustainability creates a compelling narrative for investors looking toward the future.

As the world continues to shift toward renewable energy, Tesla’s strategic initiatives on both the automotive and energy fronts promise to pay off and contribute to a transformative era for the industry.

For in-depth information about Tesla’s products, services, and updates, please visit Tesla.com. As we continue to monitor the company’s developments, be sure to check back for our next monthly update on Tesla’s performance and market position!