The Magnificent Seven: Weekly Market Recap

Welcome to your weekly overview of the Magnificent Seven stocks, where we decode the latest market dynamics to help you make informed investment decisions. This week saw notable price changes and significant news across the board, giving traders and investors a lot to think about.

—

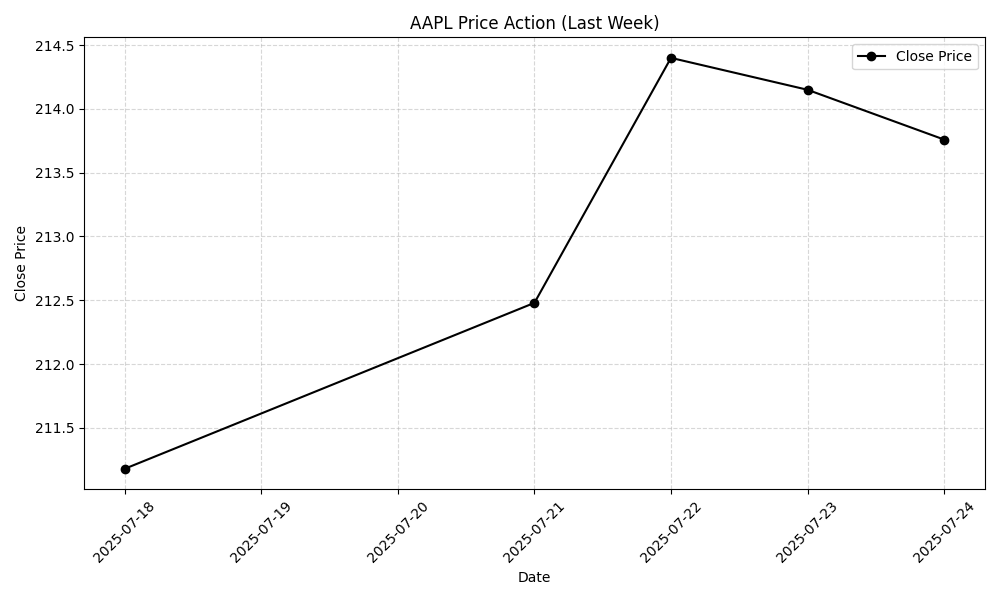

Apple Inc. (AAPL)

**Price Change:** 211.18 → 213.76 (+1.22%)

This week, Apple’s stock experienced a modest increase of 1.22%, closing at $213.76. Amidst a generally flat market where indices traded around the same levels (Dow, S&P 500, and Nasdaq), Apple’s price actions were buoyed by broader tech optimism, particularly due to Alphabet’s strong earnings as AI hopes surged. However, the UK has issued warnings to both Apple and Google regarding their dominance in the app store market, highlighting potential regulatory challenges ahead.

The market’s enthusiasm for tech stocks was further evidenced by the prospect of increased demand for Apple’s products, alongside news about an FCC-approved merger involving Paramount and Skydance, which signals ongoing consolidation in the tech and media landscape.

—

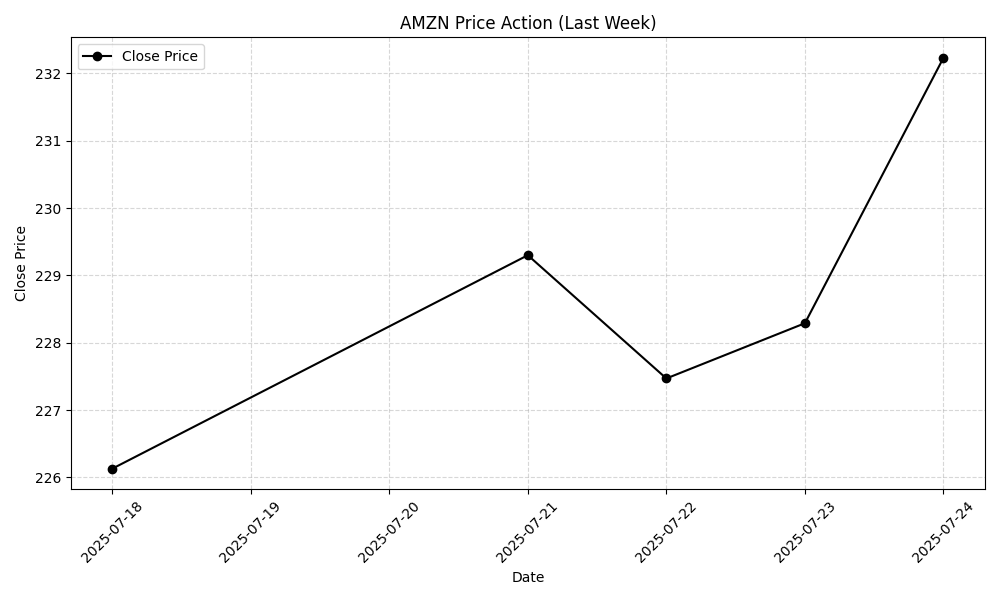

Amazon.com Inc. (AMZN)

**Price Change:** 226.13 → 232.23 (+2.70%)

Amazon’s stock rose significantly by 2.70% this week, reaching a closing price of $232.23. The e-commerce titan’s share price climbed higher than the broader market as it continues to adapt and thrive amid evolving market conditions. Key discussions paralleled Amazon’s potential benefits from increasing e-commerce activity and significant moves in the airline industry, enhancing logistics efficiency with cargo momentum.

Notably, Amazon’s visibility was amplified as Sydney Sweeney, a rising star from ‘Euphoria,’ received a boost for her new lingerie brand via backing by Jeff Bezos. The ongoing innovations and branding strategies reflect the company’s commitment to maintaining its competitive edge in the market.

—

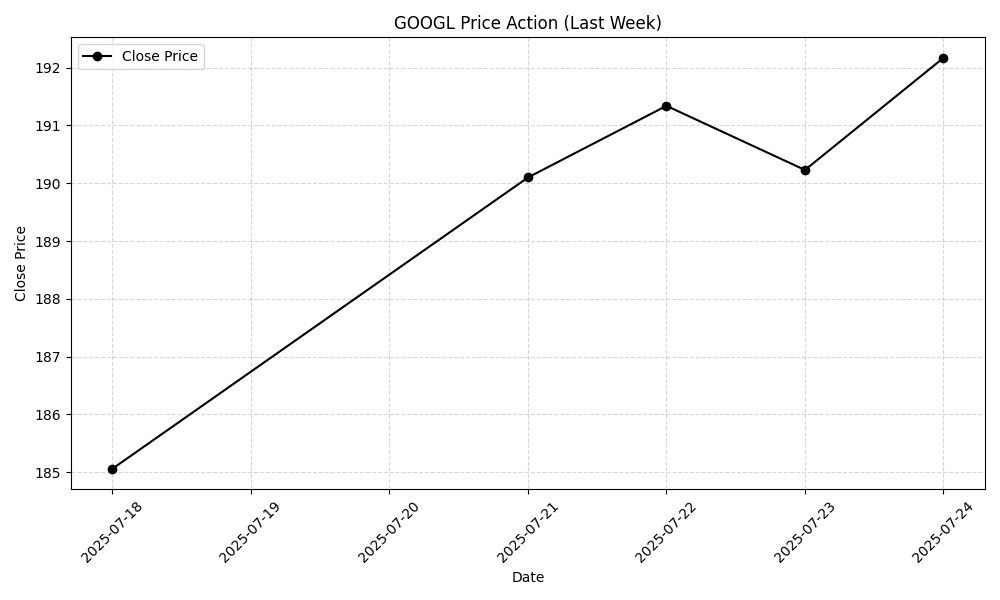

Alphabet Inc. (GOOGL)

**Price Change:** 185.06 → 192.17 (+3.84%)

Alphabet’s stock soared by 3.84%, reaching $192.17, reinforcing its footprint in the AI space following a successful earnings report. The company continues to invest heavily in AI technologies, which appears to be paying off as the market reacted positively to its advancements. Analysts noted that Alphabet’s stock remains undervalued, making it an attractive investment opportunity amidst soaring tech shares.

The news surrounding Alphabet was largely dominated by its advancements in AI and cloud services, showing that Big Tech’s focus on innovative solutions is resonating well with investors. This tech rally greatly affected overall market sentiment, making Alphabet a key player in continuing market growth.

—

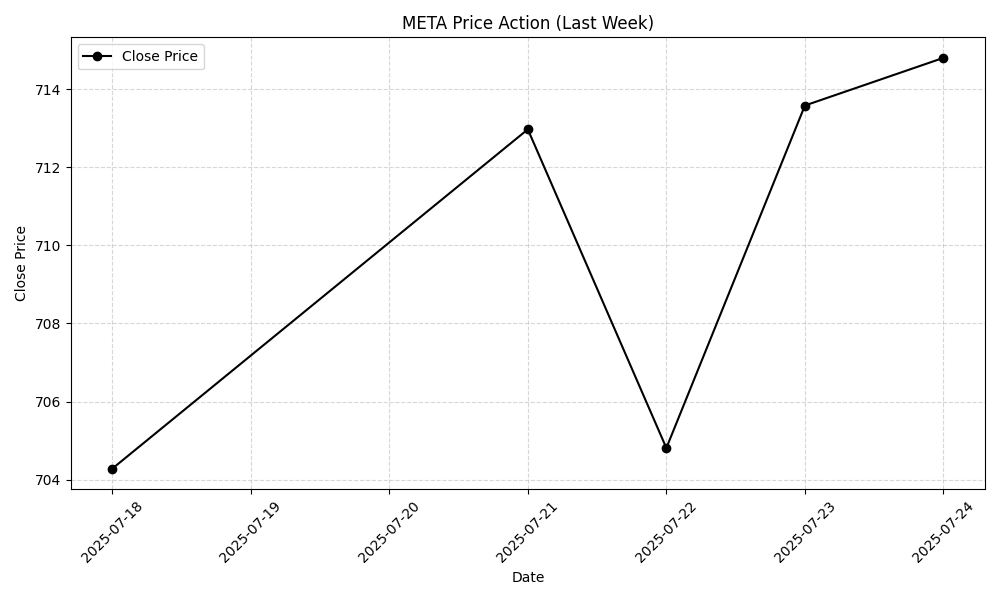

Meta Platforms Inc. (META)

**Price Change:** 704.28 → 714.80 (+1.49%)

Meta’s stock increased by 1.49%, closing at $714.80 this week, reflecting investor confidence in the social media giant. Despite facing challenges from meme stock volatility influencing market sentiment, Meta’s strategic initiatives in the AI space and commitment to advancing its advertising technology appear to be driving its stock performance.

Additionally, the continued uptick in generative AI applications is creating new demand opportunities for Meta, emphasizing its potential to capitalize on emerging trends while reaffirming its dominance in social media.

—

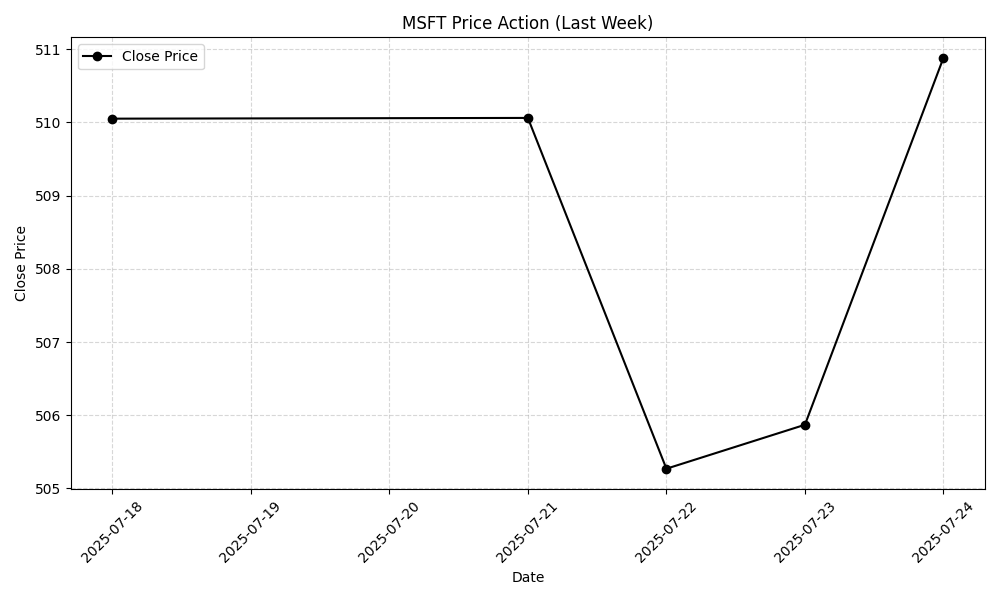

Microsoft Corp. (MSFT)

**Price Change:** 510.05 → 510.88 (+0.16%)

Microsoft’s stock barely moved this week, recording a slight increase of 0.16% to close at $510.88. Amid ongoing security concerns, particularly related to recent cybersecurity vulnerabilities, investors remain cautiously optimistic about Microsoft’s future. The company’s price target was raised to $613 by Citi, reflecting their confident outlook on Microsoft’s potential growth in cloud services and AI.

Despite the tension in the market, Microsoft continues to innovate and adapt, pushing forward with new updates to strengthen its security posture while developing advanced technological solutions.

—

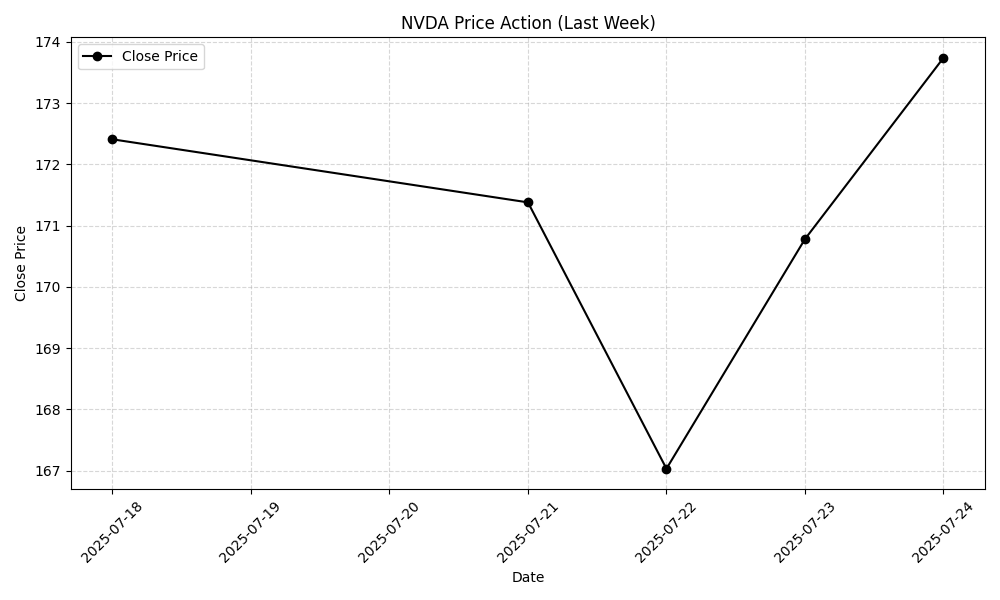

Nvidia Corp. (NVDA)

**Price Change:** 172.41 → 173.74 (+0.77%)

Nvidia concluded the week with a modest gain of 0.77%, bringing its stock price to $173.74. The company remains a staple in discussions about the AI trade, which has continued undeterred in the tech sector. Despite some volatility in other technology stocks, Nvidia’s ongoing developments in AI and partnerships position it favorably for future performance.

Market dynamics surrounding Nvidia are heavily influenced by overall sentiment regarding AI technologies, which has been a vital driver of profitability for many in the tech space. Analysts suggest that Nvidia’s innovative edge might continue to attract investor interest in the coming weeks.

—

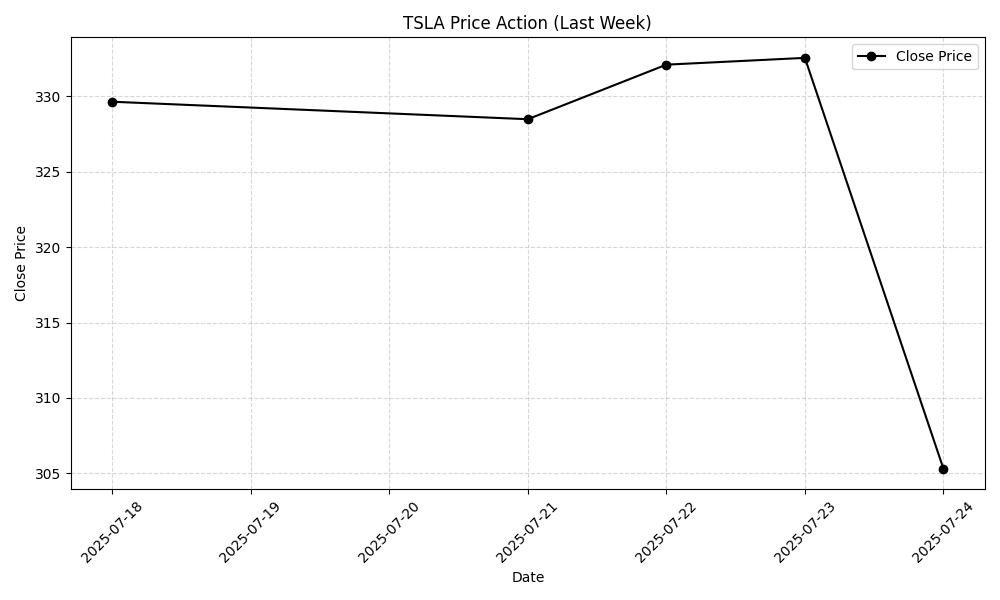

Tesla Inc. (TSLA)

**Price Change:** 329.65 → 305.30 (-7.39%)

In stark contrast to its peers, Tesla stock faced a downturn of 7.39%, closing at $305.30. This decline follows a disappointing earnings report that resulted in a warning from Elon Musk regarding several “rough quarters” ahead. Investors reacted negatively to these forecasts, leading to a notable slide in share price despite the ongoing excitement around autonomous vehicle technology.

As Tesla grapples with operational challenges and market pressures, the discourse surrounding its future capabilities in the autonomous sector will be critical in determining its recovery prospects.

—

Stay tuned for next week’s recap as we continue to explore the ever-evolving landscape of the Magnificent Seven stocks and the factors influencing their market dynamics.