In a remarkable turn of events, IQVIA Holdings Inc. (NYSE: IQV) has outshined its peers, claiming its position as the largest percent gainer in the S&P 500 over the past 24 hours. This article delves into the driving factors behind IQVIA’s spectacular performance and offers a comprehensive analysis for keen investors.

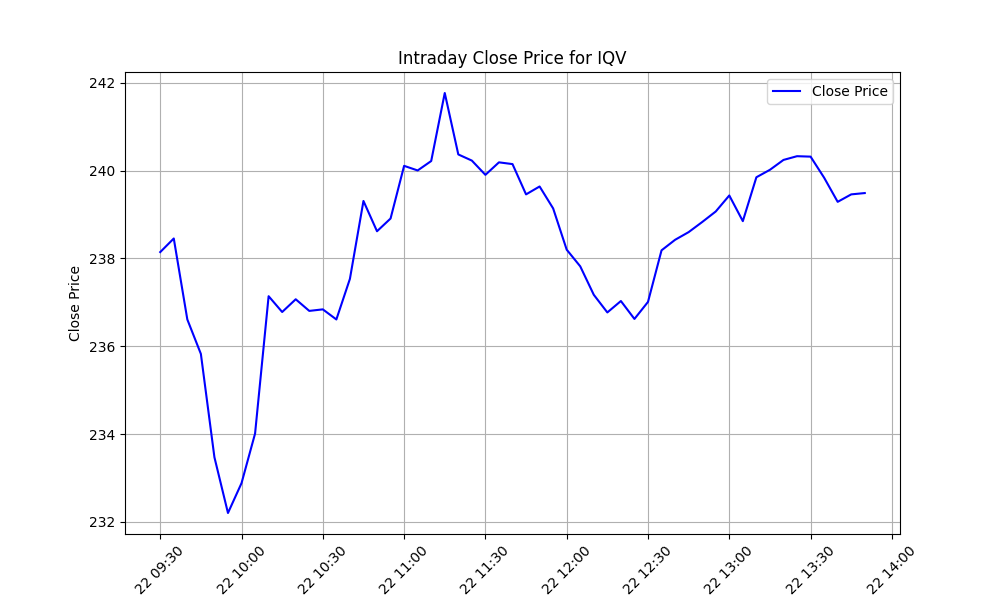

Stock Price Movement: A Day of Peaks and Valleys

IQVIA started the trading day at $238.49, quickly gaining momentum to soar to its highest point at $242.13. Throughout the day, the stock dipped to a low of $230.62 but ultimately closed at an impressive $241.88. This represents a substantial gain from the previous closing price of $224.63 – a staggering 7.68% increase. Volume also saw a noteworthy uptick, with trading volume rising by 61.49% compared to the previous day.

Recent News: Short Interest Declines as Momentum Builds

One key piece of news impacting IQVIA’s recent surge is the noticeable decline in short interest. The short percent of float has dropped by 5.39% to 1.93%, signaling that fewer traders are betting against the company. With 3.08 million shares shorted, and an average of 1.76 days to cover these positions, this reduction in short interest can foster a more bullish sentiment, cushioning the stock against bearish attacks and potentially fueling further upward movements.

Market Context: Swimming Against the Tide

While IQVIA has been a beacon of success, the broader market has shown mixed results. The healthcare sector, where IQVIA belongs, faced pressure from regulatory uncertainties and mixed earnings reports. However, IQVIA’s advanced analytics and cutting-edge technology solutions in the life sciences sector have enabled it to counteract these headwinds. The company’s ability to provide comprehensive clinical research services offers it a strong competitive edge, as evidenced in its recent performance.

Expert Opinions: Analysts Bullish on IQVIA

Experts across the financial spectrum have expressed optimism about IQVIA’s future. With an average target price of $268.36 and a high estimate of $295.00, analysts have positioned the stock well above its current price. A noteworthy analysis from Goldman Sachs highlighted the company’s innovative R&D solutions and strategic collaborations, positioning IQVIA for continued growth.

Technical Analysis: Riding the Bull Wave

From a technical perspective, IQVIA’s recent price action is compelling. Breaking above the $240.00 resistance level is a significant bullish signal. Additionally, the stock exhibits an ascending price channel, indicating a sustained upward trend. Key technical indicators such as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) support bullish momentum, with RSI suggesting that the stock is not yet overbought despite recent gains.

Future Outlook: Bright Horizons Ahead

Looking forward, IQVIA’s robust position in the healthcare market augurs well for its continued performance. The company’s innovative approaches in analytics and clinical research are likely to drive sustained growth, particularly as demand for their services increases. Furthermore, with substantial investments in technology and strategic collaborations, IQVIA is well-poised to maintain its upward trajectory.

Conclusion

IQVIA Holdings Inc. has taken the spotlight with its remarkable surge, marking it as the top performer in the S&P 500 over the past 24 hours. Backed by declining short interest, bullish expert opinions, and strong technical signals, IQVIA stands ready to navigate future market challenges with resilience and innovation. For investors seeking a blend of stability and growth potential, IQVIA remains an attractive candidate in the ever-evolving financial landscape.